Let’s review the legendary project, which carries out its

work with 2013 of the year and has become very popular worldwide, we offer you

to know about

The Fund doesn't think to slow down

and is breaking all records, it's time for us to start partnering with it and

get our share of generous profit.

- Marketing of SuperKopilka: from 1030% per month

- The deposit period: from 1 to 200 weeks

- Investment amount: from $5

- Payment systems: Nixmoney, PerfectMoney

- Payments: Manual

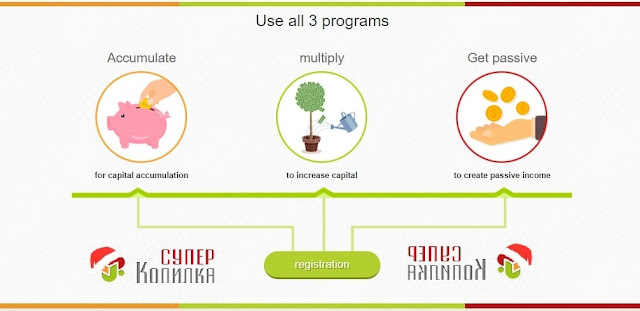

The idea behind the project is extremely simple and effectively

applied. SuperKopilka is a global mutual funding system in which individuals and

investors voluntarily interact with each other to increase their well-being.

The system works on the code of an improved self-contained automated money

handling system, which has been improved taking into account modern technologies,

high profitability, maintaining reliability and security.

Marketing in the project

The amount of passive income generated by you in the SuperKopilka

project depends on the strategy that you choose yourself or that project

consultants calculate specifically for you. In the project, this strategy is

called Passive Income Strategy (SPD).

It can also be called Loopback, comparing the principle of

operation to a loop that closes on itself and has no end. Through the payouts

of this strategy, we guarantee the creation of new programs to maintain the Loopback,

as well as the withdrawal of part of the funds to the wallet in the form of

passive income. All other participation options are not viable, as they will

not be able to guarantee passage of the adaptation.

To choose the optimal and most profitable strategy, you need

to contact a consultant. In the application, indicate the amount of passive

income you want and you will receive a detailed calculation with an individual strategy.

You can make a deposit for any amount starting from $5, but

for those who cannot decide on a strategy, SuperKopilka offers ready-made

solutions. You can also get an individual strategy calculation from a

consultant, which will be calculated according to your wishes and budget. Check

out the ready-made examples of equity strategies below to find out how much

passive income you can earn each year by making a smart startup investment.

1. Participation Strategy with $100 Contribution

- Profit accrual: $6.46 every month

- Passive income per year: $78

- Payout over 3 years: $233

- Payout over 10 years: $775

- Withdrawal start time: 1 week

- Deposit amount: $100

2. Participation Strategy with $500 Contribution

- Profit accrual: $ 31.27 every month

- Passive income per year: $375

- Payout over 3 years: $1126

- Payout over 10 years: $3752

- Start date of withdrawal: 1 month. 1 week

- Deposit amount: $500

3. Participation Strategy with $1000 Contribution

- Profit accrual: $64.28 every month

- Passive income per year: $771

- Payout over 3 years: $2314

- Payout over 10 years: $7714

- Start date of withdrawal: 4 month. 1 week

- Deposit amount: &1000

Huge Bonuses for Newbies

The opportunity for each new participant will receive $10 as

a signup bonus immediately after check-in and another $20 on first deposit. You

must deposit $20 with a week.

Loss compensation program “StopDebts”. Within 7 days from

the date of making a deposit with personal money, you can receive compensation

for a number of losses. For example, funds for using loans, mortgages, losses

incurred in SCAM projects, spent on treatment or a burned-out voucher etc.

Advertising mode. Creation of programs for short periods of

up to 16 weeks, available only to new members.

Draw "Wheel of Fortune for new participants"... A

drawing of cash prizes is held monthly. Among the newcomers of the previous

calendar month, 10 winners are randomly selected, each of whom will receive a

cash prize in the amount of 10% of the amount of their deposits.

Marketing Features:

Funds within the project are converted into domestic

currency - THETA (1teta is equal to $1).

The user can make a deposit with one deposit or make weekly

contributions. If such a fee is missed, then this payment is “booked” for the

participant, and you will also have to pay your interest rate for this week as

a penalty.

Beginners have the opportunity to create one deposit on a

test block from 1 to 4 week with a yield of 30%.

The minimum installment per week can be calculated by

dividing the total by the number of weeks.

In the project, there are torrent payments, due to which

large sums can be transferred to the balance in parts. The first receipt occurs

within 24 hours after the creation of the withdrawal request.

The project has a strategy called “Ringing” that allows the

participant to reach a stable passive income. You can calculate it yourself or

with the help of a specialist.

REFBEK simple words - read and come back!

Partnership Program

An alternative way to generate income in SuperKopilka is to

make money on an affiliate program. You don't have to build an SPD, but then

you need to invite active participants and regularly withdraw affiliate

bonuses. The referral program of the project will allow you to make a profit on

eight levels of the structure in depth.

Affiliate bonus in the amount of

10%-2%-0.5%-0.3%-0.2%-0.1%-0.1%-0.1% charged on weekly referral fees.

How to register on superkopilka.com and make a deposit?

1. You can register on the Superkopilka website by thislink. On the main page use the button "Registration".

2. To create an account, you must specify your full name,

email address, phone number, skype (if desired). Below we verify the name of

the inviter, accept the user agreement and click the button

"Register"

3. The next step is mail verification. At the specified

address will receive a letter in which you need to make the transition on the

proposed link. Next you will be asked to set a password.

4. To replenish the balance and withdraw funds to the

payment system, you will use the corresponding buttons in your account.

5. After the funds appear on your balance sheet, you can

choose for yourself one of the areas of investment and start earning money with

the project.

SuperKopilka Legit Review At Glance

SuperKopilka may be a social project that has been operating

for many years and has given several capitalists the chance to receive area

interest profit. what's the key of such longevity and success? 1st of all,

within the competent approach of the administration and mathematically

calculated investment conditions. The project works fully transparently and

every one participants will watch the flow of funds through the payment

schedule. In distinction to the classic HYIP, a project developed by the logistic

support fund can work for a protracted time and simply expertise a decline in

investor activity.

SuperKopilka offers several directions for earnings with

profitability. 10-30% per month, which is able to be of interest to completely

different investors. this is often additionally a chance to save lots of for a

few purpose with creating cash in installments, and a lot of USual for us to

speculate a particular quantity with the payment of profits at the tip or

weekly. At a similar time, there's an opportunity to earn on a progressive

eight-level affiliate program, even while not a private contribution. For

beginners who need to protest the project there is a bonus for registration,

which will facilitate to grasp the options of the SuperKopilka work from the

inside.

Risk Analysis

Any investments carry risks and also the capitalist should

take this into account, and as for this company, it's no exception. As a rule,

the risks are always proportional to the yield and the bigger the share that

the project offers, the upper the likelihood of losing money. extremely

profitable comes have increased risks, as a result of profitableness offers

serious, thus i like to recommend to follow bound rules: bear in mind to diversify and don't invest all the money in

one investment tool. it's wiser to distribute the accessible funds among many

projects so as to cut back risks.

By investment in an extremely profitable fund, be ready for

the actual fact that there's a high likelihood of losing money. Therefore,

don't use borrowed funds and people amounts, the loss of which is able to play

an oversized role for you.

Withdraw the exploit the project as typically as doable

(daily, hourly) during accordance with the tariff conditions that the project

offers! Take the choice on reinvestment while not emotion, when consideration

all the execs and cons. And bear in mind the most rule of the investor: it's

higher to receive less profit than to lose a deposit.